Final Gst Return Malaysia

The final date for the submission of this final gst return fell on 28 december 2018.

Final gst return malaysia. Amendments to the final gst 03 return if any must be made by 31 august 2020. According to the gst guides no gst adjustment is allowed to be made after 31 august 2020. Final submission gst 04 return please be informed that pursuant to section 7 of goods and service tax repeal act 2018 the non gst registrants are required to submit the final gst 04 return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 30 days from 01 09 2018 i e.

This is a new box that will be included in the gst return from periods ending on or after 1 jan 2020. Comments are turned off. Attention please be informed that this portal will remain active until further notice.

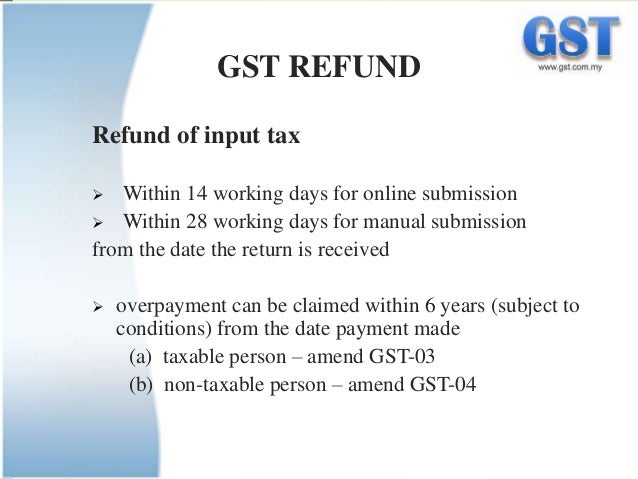

Amendment to final gst return due by 31 august 2020 malaysia s goods and services tax gst was replaced by the sales tax and services tax but there are still transitional gst issues that may need to be resolved. This is a reminder to businesses that the amendment to the final gst 03 return if any needs to be made by 31 august 2020. The one hundred and twenty 120 days period allocated by the authorities was intended to allow sufficient time for businesses to compile data for the gst return and ensure that all input tax which the gst registered businesses are eligible for are included and claimed in this final gst return.

Final malaysia gst03 submission is 29 12 2018. Registrants are required to submit the gst 03 return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01 09 2018. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia.

Based on the latest faq the rmcd has clarified that the gst final submission must include value of goods held to be reported in the gst 03 return under field 5 a. Please refer to the following schedule for better understandings final. By or before 30 th september 2018.

The gst returns for the period ending 31 august 2018 are due by 29 december 2018. If you are an overseas local electronic marketplace operator supplying digital services on behalf of suppliers listed on your platform indicate yes and include the value of such digital services that are subject to gst. Gst guide on tax invoice debit note credit note and retention payment after 1 september 2018.

For official guide from customs malaysia refer to http www customs gov my ms document. Considerations relating to filing final gst return in malaysia malaysia s goods and services tax gst was repealed on 31 august 2018 and a new sales tax and service tax sst applies as from 1 september 2018. Open stock balance report and select the date as of 31 august 2018 and press inquiry to get the amount.